- Disorderly Market Testing

- Global Algo Trading Compliance

- MiFID II & MAR Compliance

- Best Execution Testing

We specialise in creating novel, practical and high-performing solutions to some of the most challenging problems facing financial markets..

WHAT WE DO

Algo Testing, Best Execution and Algo Compliance.

For almost 20 years TraderServe has produced pioneering products and consultancy globally for algorithmic trading, best execution and algo compliance.

Since 2003 we have assisted legislators and regulators in their development of proportionate and effective algorithmic trading regulation.

Algorithm Stability & Disorderly Market Testing

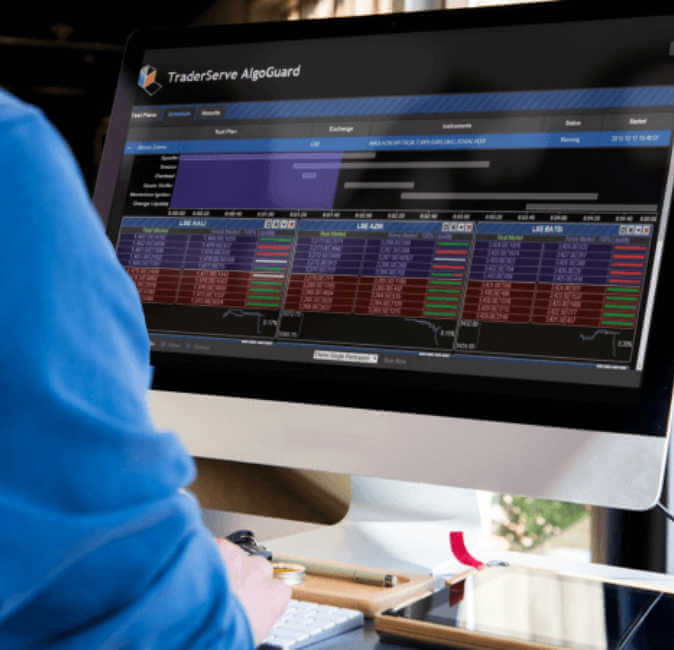

TraderServe’s flagship product AlgoGuard is the first commercially available algorithm stability testing platform which prevents deployment of algorithms which contribute to market disorder or commit market manipulation.

Best Execution

TraderServe introduces triple aspect best execution testing for algorithms, a comprehensive test suite including market impact testing.

Expert Executive Team

Nick Idelson

TECHNICAL DIRECTOR

TraderServe’s Technical Director and New Business Development with over 30 years expertise in algo trading as well as pioneering distributed algo trading and execution environments.

Nicholas Hallam

RESEARCH DIRECTOR

TraderServe’s Techical director with over 20 years’ experience in designing quantitative models, he directs the ongoing research into TraderServe’s model design and testing systems.

Tony Holder

OPERATIONS DIRECTOR

TraderServe’s Chief Operations Officer with over 20 years’ experience as a consultant for major banks, fund managers, blue chips and financial software companies.

Richard Wilson

ENGINEERING DIRECTOR

TraderServe’s lead developer with over 20 years’ experience developing both front end/user interface and enterprise server side systems.

Don’t let regulation put your algorithms out of business...

and don’t let your algorithms put you out of business either…